The Deadline is approaching quickly:

The legislation changes that were introduced in the 2012 budget by the Department of Finance will affect life insurance policies issued as of January 1st, 2017.

If you are saving money inside your corporation, to spend, or pass through your estate, Life Insurance should be considered… but the tax treatment of these policies is changing significantly.

Permanent Life insurance contracts that provide a savings component, allow policy holders to contribute more money than is necessary to cover the cost of coverage. This excess is able to grow and eventually payout on a tax-free basis. The last major changes to these rules was In 1982. Tax exempt rules were created to determine how much growth could accumulate on this tax-free basis.

Effective January 1, 2017, changes are going to be imposed to modernize the tax exempt rules and will affect all permanent life policies issued as of that date.

Impact of the 2017 Tax Changes:

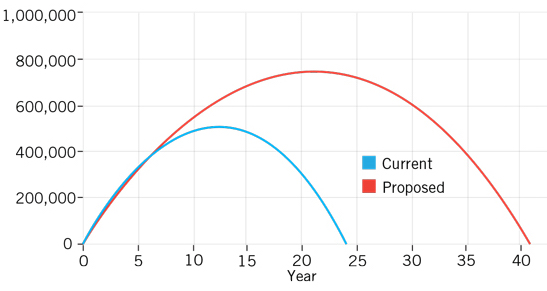

- Lower limit on the cash value that can accumulate within the policy, which means less tax-advantaged growth.

- Reduced maximum premiums or deposits means it will take longer to quick pay or overfund a policy

- Less attractive tax treatment for corporately-owned policies means lower credits to the Capital Dividend Account or CDA.

Under the new legislation:

Deposit amounts will be reduced significantly.

It will take much longer for the ACB (Adjusted Cost Base) to reach zero. (much longer for the accumulation to be paid out tax free)

Life insurance can play a very important role in an overall investment portfolio. We would strongly recommend that you look before the changes take place. This certainly isn’t for everyone but in the right situation, the impact is very meaningful.

We would be more than happy to elaborate on these upcoming changes and show you how this might fit for you and your family.

Jay Newton BA, CLU, CHS, EPC

Wealth Advisor

Newton Financial Ltd

Worldsource Financial Management Inc.

PLEASE BE ADVISED THAT WE ARE NOW LOCATED AT;

NEWTON FINANCIAL

6837 THOROLD STONE RD

NIAGARA FALLS, ON

L2J 1B2

(P) 905-356-6668